The Practical Guide to Venture Studios, Startup Studios: Building and Scaling Startups Smarter

May 30, 2025

A Comprehensive Introduction to Venture Studios and How to Build Startups with Higher Speed and Efficiency

The way people build startups is changing. Venture studios and startup studios are a key part of this change. These organizations systematically create, build, and scale new companies. They have become much more common. Around 50 existed in 2015. This number grew to over 300 by the time the Startup Studio Playbook was written. By 2025, there were over 920 globally. Idealab was the first, starting in 1996. Since then, the model has grown and proven effective.

This approach is gaining traction in the US and Europe. Studios offer a strong alternative to old startup methods. They aim for a safer, more efficient, and faster way to bring products to market. They don't just offer a supportive place for creating value ; they are active co-founders and builders.

If you want to start a company, invest in new ideas, or bring startup speed to your corporation, you need to understand the venture studio model. This guide uses insights from experts like Attila Szigeti, author of the Startup Studio Playbook, and other sources. We will cover what venture studios are and how a venture studio works. We'll also discuss their benefits, how to create a venture studio, and how they differ from accelerators or incubators.

Understanding Terms: Venture Studio, Startup Studio, and Others

The names for these company-building groups can be confusing. You might hear "venture studio," "startup studio," "venture builder," "foundry," or "startup factory" . They often mean the same thing: an organization that regularly builds startups .

What is a Venture Studio? Main Features

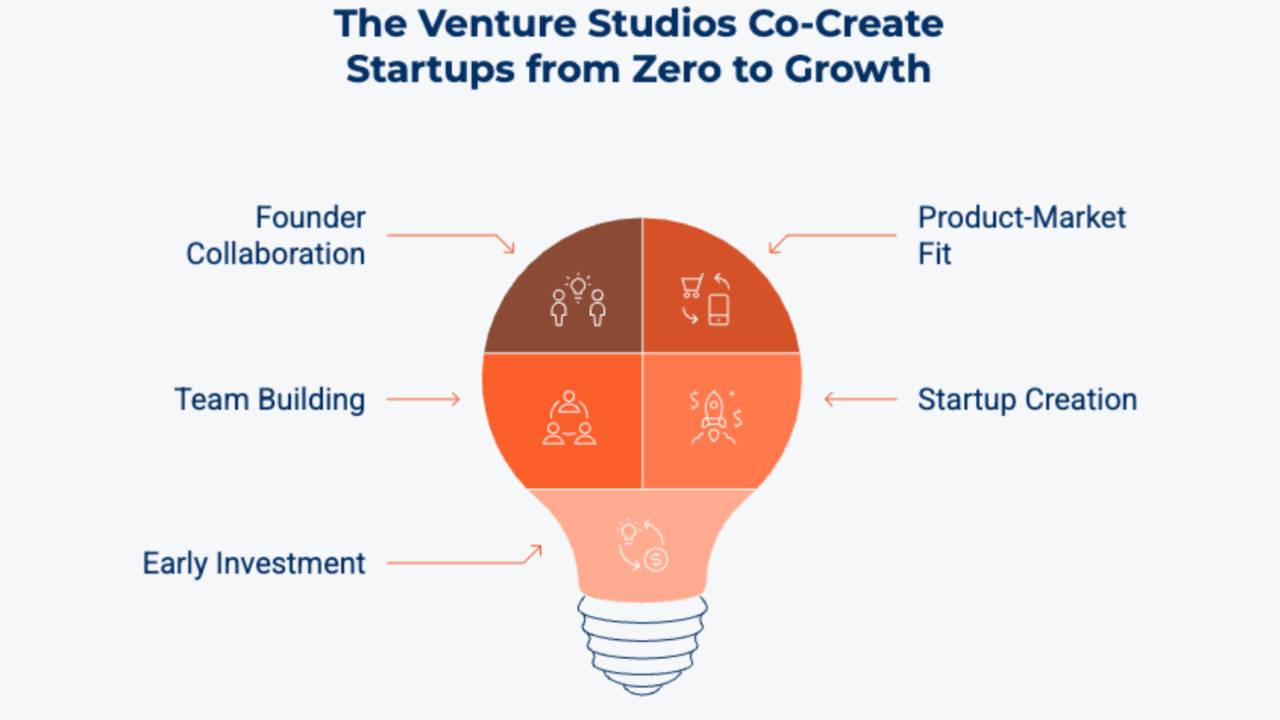

A venture studio works closely with founders to build new companies . They help find a product-market fit and build the team to grow the business . Venture studios are organizations that create startups . They take an idea from the start, test it, find a team, and invest early money in a safer environment .

Key features are:

- Building Together: Venture studios act like co-founders. They are very involved in the startup’s daily work and big decisions .

- Providing Resources: They offer money, shared tools, expert help, and direct support .

- Focus on Doing: They help turn new ideas into successful businesses through an active, complete process .

- Many Companies: They build several companies at once. This allows them to share lessons and spread risk .

Venture studios aim to give founders a team of experts and tools to build products, enter markets, get customers, and grow faster than they could alone .

What is a Startup Studio? Small Differences and Similarities

The term startup studio is often used just like venture studio . Startup studios are organizations that make companies . They are not just investors or mentors; they are the founders and builders . They help entrepreneurs focus on creating value. They do this by giving a stable base, money, people, and a place to create .

Some reports distinguish them by how they get money :

- Startup studios might use their own founders' or partners' money to start . They don't always raise an outside fund .

- Venture studios, in this view, usually get money from outside investors . They might even have their own VC fund .

But in practice, the terms are mostly the same. Both refer to groups that systematically build startups . This guide will mainly use "venture studio" but agrees "startup studio" is a common equivalent.

Main Differences: Funding, Idea Source, Involvement

No matter the name, the studio model is different in these ways:

- Idea Source: Ideas can come from the studio team , outside founders who partner with the studio , or corporate partners . Founders Factory, for example, takes ideas developed in-house and ideas from founders .

- How Involved They Are: Studios are deeply involved in operations from the very start, like a co-founder . This is different from many traditional investors who are more hands-off.

- Funding Source: Studios might use their own money, raise special funds, or get corporate backing . They give early money and help raise more later.

- Share of Company (Equity): Studios give ideas, resources, and operational help. Because of this, they usually take a large share of the companies they build, often 20-80%.

Other Names: Venture Builders, Foundries, Factories – Are They Different?

Names like "venture builder," "startup foundry," and "startup factory" are also used . Generally, these mean the same model of regularly making new companies .

- Venture Builder: Used like venture studio, stressing the active building part .

- Startup Factory/Foundry: These names point to the repeatable, process-driven way of creating many startups, like an "idea factory" .

There might be small differences in how specific groups describe themselves. But the main idea of being a company that builds other companies stays the same .

Why Studios Work: Benefits for Founders and Investors

The venture studio model is growing because it offers clear benefits for both founders and investors. Studios aim to build startups more efficiently. They change the often messy startup journey into a more organized and supportive one.

For Founders: A Safer Startup Journey

Building a tech company is hard. About 90% of startups fail . Venture studios try to improve these odds.

- Lower Risk: Studios reduce early-stage risks. They do this by checking ideas, providing experienced teams, and offering a proven building method .

- Focus on Creating Value: Founders can focus on making a good product and understanding customer needs . The studio gives a solid platform, money, and people .

- Expert Help & Mentoring: Entrepreneurs work with experienced pros. They get guidance that is more direct than simple mentoring .

- Help for New Entrepreneurs: Even first-time founders have a good chance to build a successful startup in a studio . Studios can also encourage people to start who might not have otherwise. This includes those without a specific idea or those who need a salary while building .

For Investors: Spread Risk and Better Success Rates

For investors, studios offer a good way to find well-checked and safer investment chances.

- Regular Deal Flow: Startups from a studio can be a constant source of future investments for VCs and others . Some VCs even build their own studios to create deals with better success rates than the usual "9 out of 10 startups fail" .

- Spread Risk (Diversification): Investing in a studio or its group of companies means investing in many small chances instead of one. This spreads out the risk .

- Higher Success & Exit Rates: Data shows venture studio startups are 30% more likely to succeed than regular startups. 84% of studio startups raise seed money. 72% of those reach Series A, versus 42% for regular ventures. Studio startups also get seed money twice as fast and exit 33% faster .

- Better Return Potential: If a studio owns a large part of its startups, an exit can mean much bigger returns for the studio and its investors . The IPO/Exit rate for studio companies can be much higher (e.g., 6.4% vs. 2.0% for traditional VC funds, one source states).

Exploring Key Benefits

Let's look closer at some specific advantages of the venture studio model:

-

Faster to Market:

- Studios speed up the venture building process . This gives a key time advantage over competitors .

- With ready tools, clear processes, and skilled teams, studios can go from idea to market much faster . It's reported that studio startups take 25 months from founding to Series A, while traditional ones take 56 months .

- This speed comes from using established networks, guides, and in-house experts for checking ideas and developing products .

- Studios speed up the venture building process . This gives a key time advantage over competitors .

-

Access to Shared Resources & Experts (Talent, Tools, Money):

- Studios offer a central team of skilled people – designers, engineers, marketers, sales pros, legal, and admin staff – that startups can use as needed .

- This is very helpful because startups often can't afford top talent early on . Studios can hire top people and share their skills across many ventures .

- Shared tools like office space, software, and operational systems also cut costs .

- Studios also give or help find needed early money .

- Studios offer a central team of skilled people – designers, engineers, marketers, sales pros, legal, and admin staff – that startups can use as needed .

-

More Value from Money (Capital Efficiency):

- By sharing resources and using clear processes, studios save money, making venture building cheaper .

- Using expert skills and sometimes taking company shares for work (sweat equity) can lower the cost of development . This means startups can do more or build a better first product (MVP) with the same budget .

- The aim is to be an idea-checking machine, building only what works and quickly dropping bad ideas to save money .

- By sharing resources and using clear processes, studios save money, making venture building cheaper .

-

Building Stronger (Antifragile) Organizations:

- A well-run studio can build an organization that gets stronger and better with each new idea and startup.

- Failures become lessons. If a startup fails, the team can be moved to new projects. This keeps talent and knowledge in the studio system.

-

Developing Local Startup Scenes (Ecosystems):

- Studios can succeed even where the local startup scene isn't fully grown . They create their own hub of talent, money, and chances .

- Experienced CEOs and builders in the studio improve the whole group. They add to shared knowledge and can help the local area .

- Studios can succeed even where the local startup scene isn't fully grown . They create their own hub of talent, money, and chances .

Inside the "Idea Factory": How a Venture Studio Works

To understand how a venture studio works, we look at its full process, often called the "studio funnel." Each studio may have its own style. But the general venture studio model follows steps to systematically create, check, build, and grow new companies. The goal is to turn new ideas into successful businesses through an active, complete process .

The Studio Funnel: From Idea to Exit – A General Guide

The venture building process in a studio usually involves several key steps and is repeated . It's like planning a factory, but the product is a startup .

Step 1: Creating and Finding Ideas (Internal vs. External)

- Process: The journey starts by generating many ideas . Studios are places where creative ideas are tested and improved . These ideas can come from the studio's own team (research, brainstorming, using founder skills) , from outside founders who team up with the studio , or from corporate partners . Many successful studios pick one industry or customer type to become more efficient . For instance, Betaworks focuses on media, and eFounders (now Hexa) on SaaS .

- Actions: Regular idea sessions, checking industry news for trends, talking to customers and experts to find problems.

- Result: A list of possible startup ideas, detailed enough for a first look and ranking. A scoring system might be used to choose ideas to pursue .

Step 2: Careful Checking & Market Research

- Process: Before spending a lot of money, chosen ideas are carefully checked against market facts . This includes deep research on competitors, talking to users, thinking about the business plan, and checking if the idea can work . The aim is to see if the idea can sell, if it's doable, if it fits the studio’s skills, and if it meets real user needs .

- Actions: Making landing pages, trying online marketing, direct calls, measuring customer interest, figuring out how much it costs to get a customer (CAC), and finding ways to get customers. This step is still about filtering, so it usually has a small budget and a short timeline (days to weeks) .

- Result: A proven idea with a clear view of the target market, possible problems, and chances. This step aims to lower risk. It ends with a decision to build or not. A startup pitch deck might be made .

Step 3: MVP Design & First Build

- Process: If an idea gets a "yes," the studio starts building. It focuses on the main parts for a first version (Minimum Viable Product - MVP) based on a set budget and timeline . The goal is to build something users will like, often starting with one main feature and a good design .

- Actions: Founders work with in-house experts (product design, development, marketing) to improve the MVP and launch plan . Prototyping tools are used to make mockups and a first product. This could be a simple web app made in a few weeks .

- Result: A real MVP – a digital product or service ready for first market entry and user tests. For B2B startups, this step might take longer and need more care from the start .

Step 4: Launch & Early Results (Traction)

- Process: Once the MVP is ready, the studio helps the startup prepare to enter the market . This can include branding, making a marketing website, and setting up social media . Some choose a quiet launch or private tests with potential customers first .

- Actions: Getting early users, improving the product based on feedback, finding growth methods, and making the startup’s business plan. The goal is to find a fit between the problem and market, and the product and market, and get early positive results.

- Result: Market entry with a product that hopefully gets results, like active users, paying customers, regular income, and a way to keep growing.

Step 5: Building a Team & Finding Founders (The EIR Model)

- Process: The studio gives early leadership, but each startup needs a dedicated team, especially a CEO, to grow . Studios often hire Entrepreneurs-in-Residence (EIRs). These EIRs might become the CEOs or co-founders of the new companies . An EIR mixes the skills of a traditional founder and a manager. They are trained to find market needs, guide product making, and get results .

- Actions: Finding and checking potential EIRs/CEOs based on their past work, leadership style, market connections, and ability to learn . Getting talent through networks, online branding, and community work . Teaching EIRs about startups, idea checking, sales, and management .

- Result: A dedicated CEO (and maybe a CTO or other key people) for each good project, ready to lead the startup after it separates from the studio .

Step 6: Separating (Spin-Off) & Becoming a Company

- Process: A startup usually separates from the studio when it shows good early results (like a working MVP, active users, ways to grow, or product-market fit) and is ready for outside money.

- Actions: Legally making the startup its own company . Finalizing team structures and who owns what shares (equity) . Preparing for seed funding .

- Result: An independent company. The studio often keeps shares and may still help or have a seat on the board .

Step 7: Growing (Scaling) & Managing the Group of Companies

- Process: After separating and getting seed money, the new company focuses on growing fast . The studio might still help with this growth. This can include improving the MVP based on feedback and hiring more people . Studios usually don't stay with companies until an IPO but help them grow until they are strong on their own .

- Actions: The startup CEO uses their new budget to hire more dedicated team members. They take over key tasks from the studio's main team . The studio and CEO continue to talk to investors . The studio manages its group of companies by tracking their progress, giving advice, and deciding on more help.

- Result: A growing, independent company. The studio uses its networks to help find chances for being bought, partnerships, or other ways to grow .

Step 8: Raising Money (Seed and More)

- Process: Getting seed money is a key step after early results to pay for growth . Studios often use their networks and reputation to help their companies get this money .

- Actions: Making investor pitch decks and financial plans. Studio leaders and the startup CEO often meet with investors together. The studio helps make the new company look good to outside investors .

- Result: Successful seed funding (and later Series A, B, etc.) that gives money for growth .

Step 9: Exit Plans (Selling the Company)

- Process: For many studio startups, the main goal is a successful exit (like being bought or going public). This gives money back to founders, the studio, and its investors. Studios might aim for quick exits ("easy wins") or build companies for the long term, hoping to create very valuable ones ("unicorns") .

- Actions: Making startups attractive to buyers or preparing them for going public . Using money from exits to build even more startups is common .

- Result: Successful sales or IPOs. This proves the studio's model works and gives money for new projects . In places where the startup scene is still new, studios might aim for early exits to help create a group of experienced local CEOs .

H3: Repeating and Improving: Learning, Changing, and Moving Resources

A main strength of the studio model is that it repeats and improves.

- Learning from Failure (Ending Ideas): Not all ideas will work out. Studios are made to end projects that don't work, and do it well . This means making quick, clear decisions based on set goals, deadlines, or budgets . Being able to stop unpromising projects early saves resources for better ones . If an idea has to fail, it should be quick and cheap .

- Moving Resources: When a project stops, the team members and their skills stay in the studio. They are moved to new, more promising projects. This keeps talent and learned knowledge, making the studio stronger over time . The studio becomes an "idea making and checking machine" .

- Always Getting Better: Successful studios like Founders Factory always check and update their methods. They look at market changes, how they work inside, and past wins and losses . Looking back at projects and trying new things are key to getting better .

Key Measures of Success (KPIs) for a Studio: More Than Just Numbers

To measure a venture studio's success, you need to look past simple numbers like how many startups it built .

- The One Metric That Matters (OMTM): For long-term success, the studio's OMTM should show its ability to create real value . Good choices include:

- Total income of its startups and the studio itself: This shows the studio builds products people need and can sell, has a stable system, makes good choices, and is strong when talking to investors .

- Total value of all companies in the studio's group (portfolio value): This is a good measure, but actual market results (income) are often better .

- Total income of its startups and the studio itself: This shows the studio builds products people need and can sell, has a stable system, makes good choices, and is strong when talking to investors .

- Other Important Measures:

- Number and quality of exits: Successful sales or IPOs clearly show the model works .

- How much follow-up money its companies raise: If portfolio companies can get money from outside investors.

- Time to reach key goals: Like time to make an MVP, get seed money, or reach Series A .

- How well money is used (capital efficiency): How effectively the studio uses its resources to build valuable companies .

- How many portfolio companies survive: Compared to regular startups .

- Number and quality of exits: Successful sales or IPOs clearly show the model works .

Focusing on strong KPIs makes sure the studio is building lasting, good businesses, not just "making T-shirts and coffee mugs".

Venture Studios vs. Others: How Are They Different?

The startup help field has many types of players. Knowing how venture studios are different from accelerators, incubators, and VCs is key for founders choosing a path and for investors placing money. The main difference is that the studio is a co-founder and builder . It's not just giving money or advice .

Venture Studios vs. Accelerators: How Deeply They Help and Where Ideas Come From

- Venture Studios:

- Often create ideas themselves or build them with founders from a very early point (sometimes before there's an idea) .

- Deeply involved for a long time in operations. They act as a co-builder and strategy partner . They get involved in the actual work of building the company .

- Usually take a larger share of the company (equity) because they give intense help and resources .

- The process is often specific to the startup and can take a year or more to develop an idea before looking for outside money .

- Often create ideas themselves or build them with founders from a very early point (sometimes before there's an idea) .

- Accelerators:

- Work with existing startups that already have a team and often an early product or MVP . Founders bring their ideas to the group .

- Offer short, group-based programs (e.g., 3-6 months or 6-12 weeks) . These focus on quick growth, mentoring, and networking .

- Give small amounts of money and advice for less equity (usually 5-10%) .

- Often end with a "demo day" where startups pitch to investors . They give light help and advice .

- Work with existing startups that already have a team and often an early product or MVP . Founders bring their ideas to the group .

Steve Blank once said some accelerator programs are just "marketing stunts," "producing only T-shirts and coffee mugs" . Studios aim to create ventures with more depth and impact.

Venture Studios vs. Incubators: Building vs. Helping Grow

- Venture Studios:

- Actively build companies, often from their own ideas . They are the "doers."

- Give major operational help, money, and strategy direction as a co-founder .

- Actively build companies, often from their own ideas . They are the "doers."

- Incubators:

- Help existing outside startup teams grow, often when they are very new (idea stage) .

- Give a supportive place, office space, shared tools, advice, and networking chances .

- Usually do not give money directly or manage daily operations . Their money often comes from membership fees .

- You often find incubators at universities, helping student entrepreneurs .

- Help existing outside startup teams grow, often when they are very new (idea stage) .

Venture Studios vs. Traditional VC Firms: Role in Operations and Equity

- Venture Studios:

- Are operational co-founders. They are deeply involved in building the business from the start .

- Invest their own resources (people and money) and skills directly into making the company .

- Take a large equity share because they are a main builder and help reduce risks .

- Are operational co-founders. They are deeply involved in building the business from the start .

- Traditional VC Firms:

- Mainly give money and strategic advice/network access to existing startups that have already shown some success .

- Usually do not get involved in the daily work of the companies they invest in .

- Their equity share is for the money they invest. Their focus is on making money through growth and exit .

- Mainly give money and strategic advice/network access to existing startups that have already shown some success .

Venture Studios vs. Angel Investors: Direct Help vs. Mostly Money

- Venture Studios:

- Offer intense, direct operational help, strategy advice, and shared tools along with investment . They are active partners in the startup's development.

- Offer intense, direct operational help, strategy advice, and shared tools along with investment . They are active partners in the startup's development.

- Angel Investors:

- Usually wealthy people investing their own money in new startups .

- Some angels are active mentors. But many are more hands-off, letting founders keep control of management . Their main help is money, though their experience and network can also be useful.

- Usually wealthy people investing their own money in new startups .

When to Pick Which Model: A Guide for Founders

The best option depends on what a founder needs, the startup's stage, and views on equity and operational help.

-

Pick a Venture Studio if:

- You are very new, maybe with just an idea or want to check one, and want a co-founding partner .

- You want deep, direct operational help, access to a skilled team, and shared tools .

- You want to greatly lower startup risk and get to market faster .

- You are an experienced pro who can build and manage teams but may not have a "killer idea" or tech team ready .

- You are willing to give up a larger equity share for these benefits .

- You are very new, maybe with just an idea or want to check one, and want a co-founding partner .

-

Think about an Accelerator if:

- You have a team, a checked idea, and maybe an early product (MVP) .

- You want a set program, advice, network access, and a small amount of seed money to grow fast in a short time .

- You prefer to keep more equity and control .

- You have a team, a checked idea, and maybe an early product (MVP) .

-

Look at an Incubator if:

- You are at the very first idea stage and mainly need a supportive place, basic tools (like office space), and community help to improve your idea .

- You are not yet ready for intense building or large funding .

- You are at the very first idea stage and mainly need a supportive place, basic tools (like office space), and community help to improve your idea .

-

Talk to VCs or Angel Investors if:

- You have a working startup with proven results and a clear growth plan, and mainly need money to grow bigger.

- You prefer to keep more control over operations (though VCs often take board seats and give strategic advice).

Venture studios can also work with traditional VCs and angel investors. They can add operational help to financial investments .

The Equity Question: Understanding Studio Stakes and Why They Take Them

A common question about the venture studio model is about company ownership: how much equity does a venture studio take from its startups? Usually, it's a lot. But this is because the studio gives huge value and resources from the very start.

Typical Equity Shares: What the Numbers Show

- Venture studios often take a big part of the ownership in the companies they co-create. This can range from 30% to 70%. It is important to understand that Venture Studios are co-founders of the startups, actively building them.

- The GSSN Data Report 2022 said studios usually keep 20-40% equity, sometimes more, rarely less . The average equity stake studios take when a company starts is around 50% .

- The exact share can change. It depends on the studio's way of working, when the founder joins, and if the idea came from inside the studio or from an outside founder.

This might seem high next to an accelerator (which might take 5-10%) or an early investor. But it's important to see the full picture.

Why They Take a Large Stake: The Value Studios Give (Idea, Team, Money, Services)

The large equity share is because the studio acts as a real co-founder. It's often the main force in starting and developing the startup early on.

- Idea Creation & Checking: Often, the studio gives the first, checked business idea .

- First Team & Leaders: The studio builds the main team. It hires key leaders (like the CEO/EIR) and gives experienced operations staff .

- Seed Money & Resources: Studios give the first money, tools (office space, software), and shared services (legal, HR, finance, marketing, design, development) .

- Lowering Risk: The studio has already cut many early startup risks. It has checked the product, found a market fit, and got early customers, often before a main CEO is fully in place .

- Speed & Good Work: The studio's set processes and skilled team speed up development and market entry .

Basically, founders who join a studio-made venture often get a much safer chance. Much of the basic work is already done or started . The studio isn't just an investor; it's the main founder and builder .

Effect on Founder Drive and Future Money Rounds

A common worry is if a large studio share might make the startup's team less driven or make it harder to get money later.

- Founder Drive:

- Studios need to find and hire people who get and want the studio model's benefits. These people must accept the different equity deal .

- The argument is that the value given (salary, tools, lower risk, better success chance) makes up for the smaller equity share compared to starting all alone .

- Clear talk and agreement from the start are very important. Investors will check team drive, so the studio must show its founders and teams are passionate and committed.

- Studios need to find and hire people who get and want the studio model's benefits. These people must accept the different equity deal .

- Future Money Rounds:

- Smart investors know the studio model and the value it brings. But a very large studio share could be a problem if it leaves too little equity for the founding team to stay motivated later, or for new investors.

- It's common for the studio's shares to be changed in later money rounds. This might give more equity back to the startup team to keep them driven or to make a more normal ownership setup for new investors .

Talking About Equity and How It Changes Over Time

- Equity talks are key. The studio's help doesn't stop at launch. They often keep giving support, strategic advice, and network access .

- If an outside startup team joins a studio, the studio might act like a big co-founder. It might take a smaller share for its work and effort ("sweat equity") .

- By the time a startup gets to Series A, B, or an exit, the studio's equity share might become smaller, like an angel investor's. This depends on how much the studio keeps helping and on new investment rounds .

- Control is also a tricky topic. Usually, studios have a lot of say in what gets built at first . But once a company is launched, the founding team often works independently but can still use studio resources and experience .

The main thing is to be open. The equity setup should match the interests of the studio, the startup team, and future investors for long-term success.

How to Create a Venture Studio: A Practical Step-by-Step Guide

Building a venture studio is like designing and running a factory for startups. It's complex but can be very rewarding. If you're thinking about how to create a venture studio, this section gives practical steps. It uses known methods and advice on help with venture studio building. This isn't just for making a startup studio; it's for creating a lasting system for making new companies.

Step 1: Set Your Vision, Mission, and Focus (Industry/Tech Area)

Before you start, you need a clear plan.

- Main Ideas & Beliefs: First, list your personal and company ideas, beliefs, limits, and what you assume. What drives you? What change do you want to make?

- Vision & Long-Term Goal: Plan for many years – 5, 10, or more . Make sure this fits your personal life and values . Studios usually focus on the early building stage, not on growing one huge company themselves . The startups are the products; the studio is the factory .

- Focus – Market or Technology: It's often key to specialize .

- Pick an industry or tech area where you (as a founder) have experience, know people, and understand the details . This greatly lowers risk .

- Don't go into new, unknown markets until your studio has a good record .

- Successful studios often focus on one area. For example, eFounders chose SaaS, and Betaworks chose media .

- Pick an industry or tech area where you (as a founder) have experience, know people, and understand the details . This greatly lowers risk .

- Startup Type: Decide what kind of startups your studio will make . Will they be similar in type, tech used, or will you build unique ones? This choice affects the tools, processes, and team skills you'll need .

- How to Check Markets:

- Do you have personal experience and contacts there?

- What are the trends (customer and investor)?

- Who are the main big companies and startups?

- Are there unsolved problems or new chances no one sees?

- Can you reach customers?

- Could you build a lasting advantage here?

- What makes it hard to enter this market?

- What are typical startup features in that area (like average time to exit)?

- Do you have personal experience and contacts there?

- Your Main Idea (Thesis): After checking the market, form an idea about what kinds of startups you can make that meet the needs and chances you found . Aim for areas where you can make good profits . Solve real problems that have a proven market need .

Step 2: Your Studio Plan - Business Model and Setup (Holding Co, Fund, Two-Part)

With a vision and focus, decide how your studio will work and handle money. There are three main ways to set up a startup/venture studio :

-

Holding Company:

- Setup: The studio creates and funds startups, owning a part of them . To start, the studio gets investments by offering investors a share in the holding company itself .

- Good Points: Simple to understand and set up at first.

- Bad Points: May not attract traditional fund investors as much.

- Setup: The studio creates and funds startups, owning a part of them . To start, the studio gets investments by offering investors a share in the holding company itself .

-

Fund as a Startup Studio (Studio Fund):

- Setup: All money (founder's money, investor money) is in a fund structure . The studio might get a fee for managing it and a share of profits (carry) . The fund directly owns all shares of the companies created .

- Good Points: Fits with how traditional VC funds work. This might make it easier to get investors who know funds . It also makes costs clear .

- Bad Points: More complex rules and reporting.

- Setup: All money (founder's money, investor money) is in a fund structure . The studio might get a fee for managing it and a share of profits (carry) . The fund directly owns all shares of the companies created .

-

Two-Part Model (Holding Company + Fund):

- Setup: This combines a holding company (for operations, main team, ideas) and a separate fund (for investing in the startups created) . This is a common way .

- Good Points: Clear separation of work and investments. Can be flexible for raising money and making deals.

- Bad Points: Hardest to set up and manage.

- Advice: It might be easier to start with a holding company. After you show the studio works, you can change to the two-part model .

- Setup: This combines a holding company (for operations, main team, ideas) and a separate fund (for investing in the startups created) . This is a common way .

Step 3: Building Your Core Team: Key Roles and Skills

The core team is the engine of the studio . Building this team is harder than for a single startup because they will work on many projects at once .

- Needed Skills: Your studio should ideally offer all skills a startup needs: development, design, marketing, sales, legal, admin, finance, HR, etc. .

- Key Roles: (More details in Section 7)

- Studio Leaders (Founders/CEO)

- Venture Builders / Product Managers

- Entrepreneurs-in-Residence (EIRs)

- Functional Experts (Engineering, Design, Growth)

- Studio Leaders (Founders/CEO)

- Team Features: Team members need great teamwork skills. They also need to be able to switch focus between projects. They must love building ventures .

- Getting & Keeping Talent: This is a big challenge. Offer good pay, a good work environment, and maybe shares in the studio's whole group of companies. A strong company image as an employer is very important .

Step 4: Getting First Money: Funding Your Studio

Studios need a lot of money, especially at first. This is to build a full core team and fund many projects.

- How Much You Need First: Figure out how much you need each month to keep the core team working until your first successful startups bring in money. This can take years . A yearly budget can be $1M-$2.5M or more .

- Ways to Get Money: (More details in Section 8)

- Founder's Own Money: Many successful studios are started by founders who use their own money at first .

- VCs, Companies, Family Offices, Angels: These can invest directly in the studio or a special studio fund .

- Agency Work/Bootstrapping: Using money from client services to fund internal startup making. This needs careful balancing of short-term money vs. long-term building .

- Founder's Own Money: Many successful studios are started by founders who use their own money at first .

- Being Trusted is Key: Raising money for a new studio with no record is hard. You'll need to convince investors your team can build many successful companies .

Step 5: Setting Up Your Studio Funnel and Processes

With a team and first money, plan your venture building "assembly line" .

- The Studio Funnel Stages: (Covered in detail in Section 3)

- Idea Making (Ideation)

- Checking Ideas (Validation) (and go/no-go decisions)

- First Build & Early Version (Prototyping)

- Separating companies (Spinning off)

- Growing and Managing the group (Scaling and Portfolio Management)

- Idea Making (Ideation)

- Process Design: This is a process you repeat and improve. It's best done with tools like Design Thinking, Lean Startup, Business Model Canvas, whiteboards, and spreadsheets.

- Important Things to Think About:

- How much will you spend on checking ideas?

- What are your rules for go/no-go decisions?

- How will you share out resources and handle fights for them?

- What is your way of "ending" ideas and moving teams?

- How much will you spend on checking ideas?

Step 6: Legal and Work Setup

Make your studio's structure and how it works official.

- Forming a Legal Company: Make the studio (and maybe its fund) a legal company based on the business model you picked (Holding Co, Fund, etc.).

- Standard Contracts: Make templates for:

- EIR contracts

- Founder contracts for new companies

- Shareholder contracts

- Service contracts between the studio and its startups (if you do this)

- Contracts for owning ideas (IP assignment).

- Idea Ownership (Intellectual Property - IP): Have clear rules for who owns ideas and how they are transferred. This applies to ideas made inside the studio and those from outside founders .

- Work Tools: Set up shared services: HR, finance, legal, marketing tools, office space (if you have one) . Use common good tools like Slack, Dropbox, GSuite, Jira .

- Rules for Running: Decide how decisions are made, if there's a board, and who advises.

Step 7: Building Your Network (Investors, Mentors, Company Partners)

A strong network is very important for a venture studio.

- Investor Network: Build relationships with investors who might invest later and companies that might buy your startups.

- Mentor Network: Get experienced entrepreneurs and industry experts to advise your studio and its companies .

- Company Partnerships: Working with big companies can give market access, chances to test products, industry knowledge, and ways to sell your startups.

- Talent Contacts: Build contacts to find EIRs, co-founders, and core team members .

Reality Check: Are You Really Ready?

Before you fully commit, check things carefully. Ask yourself and your partners important questions :

- Does the vision fit your personal long-term plans?

- Is the market you picked good enough? Do you have a special advantage?

- Can you reach the key people you need to start?

- Can you get the first money to fund your first few companies?

- Is your financial plan realistic?

- Are you ready for daily work problems, resource fights, and managing many companies?

- Do you really want to spend the next 5-15 years building new companies, helping them start, only to let them go and grow on their own? This means learning to "let go" .

Building a venture studio is a long journey, not a quick race . It needs strength, smart thinking, and a real love for making companies . If these steps make sense and the challenges seem exciting, then leading a studio might be for you .

The Dream Team: Who You Need in a Venture Studio

A venture studio's success depends heavily on its team's quality, skills, and teamwork . Unlike a single startup team focused on one product, a studio team works on many ventures at once . This needs a special mix of skills and a certain way of thinking. Building this "dream team" is a vital part of how to create a venture studio. Here are the key roles in a venture studio.

Studio Leaders (Founders, CEO, Managing Partners): Setting the Course

- Role: These people set the main vision, plan, and feeling for the whole studio. They often design the studio's special method and focus for building companies .

- Tasks:

- Choosing the studio's focus (industry, tech) .

- Talking to investors and raising money for the studio itself.

- Building and managing the main team (until a special HR person takes over).

- Making the final yes/no decisions on ideas and startups.

- Creating the studio's culture and ways of working.

- Building the studio's outside network of partners, investors, and advisors.

- Choosing the studio's focus (industry, tech) .

- Who they are: Often successful entrepreneurs who have built and sold companies before . They know their industry well, have leadership skills, and can "grow themselves" by helping others succeed . They need to be okay with the early stages of making companies and letting go as startups grow up .

Venture Builders/Studio Leads/Product Leads: Doing the Hands-On Work

- Role: These are the people in the studio who do the actual work. They take ideas through checking and first building stages . A Venture Builder at Founders Factory, for example, gives most of the direct help during the building phase .

- Tasks:

- Leading the work to check new ideas .

- Working with expert teams to make MVPs (first versions of products) .

- Managing timelines and resources for specific new companies.

- Possibly acting as temporary product managers or project leaders before a dedicated startup CEO starts.

- Guiding EIRs or early startup teams .

- Leading the work to check new ideas .

- Who they are: Experienced product managers, project managers, or entrepreneurs who are good at getting things done. They need to be skilled in lean methods and quick changes.

Entrepreneurs-in-Residence (EIRs): Future Startup CEOs

- Role: EIRs are very important for many studios. They are possible founders or CEOs for the new companies . They are a mix of a traditional founder and a manager .

- Tasks:

- Leading the checking of an idea they are given .

- Working with the studio team to create the product and business plan .

- Taking charge of the startup when it's formed. They handle its growth, sales, and raising money .

- Leading the checking of an idea they are given .

- Who they are: People with a drive to start things, leadership ability, and often some knowledge in a specific area . They can be experienced entrepreneurs looking for a new project or promising people the studio trains . They must be willing to work on ideas they might not have thought of themselves and accept the studio's equity share .

- Choosing & Training: Studios need good ways to pick, bring in, and train EIRs . This includes teaching skills like idea making, checking ideas, business planning, sales, and talking to investors .

Functional Experts (Central Teams)

To give full support, studios have a main team of experts in different functions. Their skills are shared across many new companies .

- Product Management & Design (UX/UI):

- Shapes product plans, user experience, and how products look for new companies.

- Makes sure products focus on users and meet market needs .

- Engineering & Development:

- The tech team that builds MVPs and first product versions.

- Needs to be quick and able to work on different projects and types of tech. Finding software engineers in popular areas is hard .

- Marketing & Growth:

- Makes and uses plans for getting users, branding, and entering the market for new startups.

- Skills in online marketing, making content, PR, and growth methods are key.

- Sales & Business Development:

- Focuses on getting early customers, setting up sales methods, and making key partnerships.

- Finance & Operations:

- Manages the studio's money, budgets, and may give financial advice to its companies.

- Handles daily work, tools, and admin support.

- Legal & HR:

- Handles legal things for the studio and its startups (starting companies, contracts, IP).

- Manages hiring, onboarding, and HR for the main team and maybe for new companies at first.

How to Set Up the Team: Central vs. Dedicated Teams

Studios set up their teams in different ways. They try to balance shared resources with focused help.

- Fully Central: Most or all experts are in a shared main team. They are given to new companies as needed. Only the CEO (EIR) might be fully dedicated to a startup at first.

- Good: Uses resources best, saves money, shares knowledge well .

- Bad: Might have fights for resources, less focused help for each startup.

- Good: Uses resources best, saves money, shares knowledge well .

- Dedicated Teams: Each startup has its own full team from early on.

- Good: Deep focus, strong teamwork in the startup.

- Bad: Costs more, less flexible, knowledge might not be shared well.

- Mixed Model: Some skills are central (like market research, first design). Key roles like CEO and CTO are dedicated or ready for new companies. This is a common way .

Studio leaders must make clear rules for sharing resources. They should also think about what individual team members prefer as much as they can . Some regular tasks can also be given to outside workers or freelancers. This helps use senior talent for more important work . Good time tracking tools are also needed when main team members work on many startups .

Building this varied team needs a strong culture of trust, ownership, and working together. This is key to making many startups successfully .

Getting the Money: Financial Plans and Fundraising for Studios

A venture studio needs a lot of money to work well . It needs money for its main team and tools. It also needs money for the first investments in the many startups it plans to launch. This part looks at financial planning for a studio and different ways to raise money.

Financial Planning for a Studio: Costs, Income, Value

Good financial planning is key. It helps plan cash flow, figure out money needs, and show investors the studio can work . This is best done by starting with rough plans, maybe on a whiteboard, then using spreadsheets for details .

Main Parts of a Studio's Financial Plan:

-

Figuring Out Startup Costs (For Each New Company):

- Idea Costs: Time and money for making and researching ideas .

- Checking Costs: Time and money for checking ideas (e.g., landing pages, ad money, market research) . This could be around €10k-€20k for some studios over 3-6 months for a group of ideas .

- First Build Costs (MVP): Time for design, development, product management; tool costs; specific marketing costs for launch .

- Core Team & Leader Costs: A share of the salaries and general costs of the main studio team working on that specific new company .

- Example: A studio might set a budget (e.g., €10k-€20k) and time (3-6 months) for a startup to be ready for seed investment .

- Idea Costs: Time and money for making and researching ideas .

-

Planning the Studio Funnel & Cash Flow:

- Number of New Ideas Entering the System:

- Success Rates (Pass-Through Rates):

- How many new ideas become checked ideas .

- How many checked ideas become first products/MVPs .

- How many new startups get seed funding .

- How many new ideas become checked ideas .

- Costs at Each Step: Total costs based on how many new companies move through each step .

- Studio Running Costs: Rent, utilities, salaries of main staff not specific to one company, legal, accounting, tools, etc. .

- Money Coming In (If Any):

- Agency work / consulting fees (if the studio does this) .

- Management fees (if the studio has a fund structure) .

- Service fees charged to its startups (must be open and fair) .

- Agency work / consulting fees (if the studio does this) .

- Money Needs: The plan should show the cash flow to find out how much money is needed each month to keep working until exits or other income starts . This can take years .

-

Value of All Companies and Ownership Plans:

- Use success rates to guess the number of successful startups .

- Plan typical investment round sizes and company values before new money at each stage (Seed, Series A, etc.) .

- Show how the studio's ownership share might decrease with more funding rounds .

- Guess potential exit values and the studio's return on investment .

- Include plans for giving shares to employees (ESOPs) in the new companies .

- Use success rates to guess the number of successful startups .

Spreadsheet Help: The Startup Studio Playbook mentioned plans for spreadsheet templates . The general idea is to have one sheet for each startup's cash flow. Then use another sheet for the whole studio funnel, linking the numbers .

Raising Money for the Studio Itself: Where to Get It

Getting money for the studio's work and first investments is a main challenge, especially for new studios. Here are common sources:

-

Founder's Own Money & Self-Funding:

- Many successful startup studios were first funded by their founders . This is especially true if they are successful entrepreneurs who have sold companies before .

- If you have money to fund your first 5-10 startups, you can start building and show results before asking outside investors .

- Many successful startup studios were first funded by their founders . This is especially true if they are successful entrepreneurs who have sold companies before .

-

VC Investment in the Studio:

- Some studios, especially those with experienced and well-connected founders, raise VC money directly for the studio company (the holding company) . This money funds operations and new projects .

- Being trusted by VCs is key. The studio founder's record and early results help convince them . It's harder for a new, unproven studio to get this kind of investment .

- Some studios, especially those with experienced and well-connected founders, raise VC money directly for the studio company (the holding company) . This money funds operations and new projects .

-

Corporate Money & Partnerships:

- Big companies are using the studio model more for innovation . They give funds to a studio to build startups that fit their long-term goals .

- This can mean making a studio inside the company or partnering with an outside one . AXA's Kamet Ventures is an example .

- Big companies are using the studio model more for innovation . They give funds to a studio to build startups that fit their long-term goals .

-

Family Offices, Angels, and Private Investors:

- These investors are looking at direct investments in studio holding companies . They like the idea of investing in many new startups at once, possibly better equity terms than usual angel rounds, and the lower risk of the studio model for a group of companies .

- But, "startup studio as a way to invest" is still new to many investors . Thibaud Elziere’s letter about eFounders' eClub is a good read on this .

- These investors are looking at direct investments in studio holding companies . They like the idea of investing in many new startups at once, possibly better equity terms than usual angel rounds, and the lower risk of the studio model for a group of companies .

-

Special Studio Funds:

- The studio can raise its own venture capital fund. This fund invests in the startups the studio creates . This gives a clear setup for investors (LPs) and can include management fees and a share of profits for the studio partners .

- This model makes costs clear for both the studio and its investors .

- The studio can raise its own venture capital fund. This fund invests in the startups the studio creates . This gives a clear setup for investors (LPs) and can include management fees and a share of profits for the studio partners .

-

Bootstrapping & Agency Work:

- It's possible to change an existing agency (like software development or marketing) into a studio . Or a new studio can do agency work to make money. This money then funds internal startups .

- The main problem is balancing short-term client work with long-term focus on internal startups . This needs strong decisions from leaders and team agreement .

- It's possible to change an existing agency (like software development or marketing) into a studio . Or a new studio can do agency work to make money. This money then funds internal startups .

Pitching Your Studio to Investors: What to Put in a Strong Deck

Once your vision, plan, funnel, and financial model are ready, you need to sell it to investors . Your fundraising deck must be strong and answer investor questions. Key parts include :

- Short Summary: A quick look at the chance.

- Financial Summary: Key numbers and how much money you need.

- Studio's Vision & Investment Idea: What you build, why, and what makes you special.

- Focus Area: Market size, trends, why this area is ready for new things.

- Your Special Value / "Secret Sauce": What makes your studio different and likely to win.

- The Studio Funnel: Detailed steps, timelines, and ways you create startups.

- Spin-Off Process & Future View: How startups become independent, expected growth, and values.

- Key Team Members & Skills: Show your experienced team.

- Plan for Finding EIRs/CEOs: How you'll get top startup leaders.

- First Group of Companies (If Any): Ideas or early startups already started.

- Key Advisors: Trusted names who support you.

- Fundraising Details: How much money you want, how you'll use it, expected returns, and good points for investors.

- Roadmap: Goals for the studio.

- Extra Slides: General info on the studio model, trends, examples of other successful studios.

Talking to Investors: Explaining the Studio's Value

Teaching investors about the studio model is very important, especially if they don't know it well .

- Build Trust Slowly: Talk to new investors as a studio first . Once they invest in one of your companies and see it do well, getting more investment might be easier .

- Answer Equity & Drive Questions: Be ready to talk about why your equity setup is fair and how you keep startup teams wanting to succeed. Let investors talk to your team and CEOs .

- Stress Studio as Co-Founder: Make it clear the studio is not just an investor but an active builder and main partner from the start .

- Good Points for Investors:

- A look into many possible later investment chances.

- Possible special rights for investing.

- Experience with building many companies (good for hands-on angels).

- Greatly lowers the "team risk" for new companies.

- Chance for higher equity and better ROI when companies exit.

- Talk About Risks & How You Handle Them: Discuss possible problems like startups depending too much on the studio. Explain how your spin-off process makes sure startups can be fully independent.

Reading and sharing info like Attila Szigeti's Startup Studio Playbook with potential investors can help these talks and raise your chances of getting money . It takes time to get investors on board. But once you get money, the "fun" part of building a whole group of new companies can start .

Facing Problems: Common Challenges and Risks for Venture Studios

The venture studio model has many good points. But it also has its own set of challenges and risks. People wanting to build studios and founders joining them need to know these problems to handle them well. Understanding these issues is part of how to create a venture studio that lasts and stays strong.

H3: Needing Lots of Money at First

- Problem: Venture studios need a lot of money upfront . This is to build a full core team, pay for tools and space, and fund many projects at the same time before they make money . The average yearly budget for a startup studio can be around $1.36M to $2.49M .

- Risk: If a studio doesn't get enough money at the start or have a clear way to make money (like through agency work or a well-funded fund), it can run out of cash . This can happen before its new companies grow up or sell for a profit. This could lead to a "zombie studio" that can't keep working for several years .

- Solution: Good financial planning is needed . Get large early funding from different places (see Section 8). Or have a part of the studio that makes money (like agency work, but this has its own problems of focus) . Founders who have sold companies before often use their own money for the start .

Finding and Keeping Top Talent (Core Team & EIRs)

- Problem: It's hard to find and keep very skilled people for the main team (engineers, designers, marketers). It's also hard to get talented Entrepreneurs-in-Residence (EIRs) to join . These people need a special mix of startup spirit and the ability to work on many projects. Sometimes these are projects they didn't think of themselves .

- Risk: Not enough talent can slow down how fast new companies are built. It can also lower the quality of the startups made . If many people leave, it can stop projects and lose important company knowledge.

- Solution: Offer good pay (salary and maybe shares in the studio's whole group of companies). Create a strong and exciting work culture . Give chances to make a big impact and learn a lot. Build a strong image as a good employer . For EIRs, a clear offer, fair equity deals (even if different from traditional startups), and a path to become CEO are key .

Founder Drive and Worries About Equity Shares

- Problem: The studio takes a large share of the company (often 30-80%) . This can cause issues. It might make people worry about how driven the startup's main team is, especially the CEO/EIR.

- Risk: Founders who are not driven enough might not work as hard as needed for a startup to win. Future investors might also worry if the founding team owns too little of the company.

- Solution: Be open about equity shares and the value the studio gives from the very start . Hire entrepreneurs who get and value the studio model's good points (less risk, resources, salary) . Set up equity so it can be changed in later rounds to keep the team motivated or attract new investors . Make sure the studio keeps adding value even after the startup separates .

Convincing Investors Who Are Not Sure (Especially for New Studios)

- Problem: Raising money for the studio itself (or its first companies) can be hard. This is especially true if the studio is new and has no record, or if investors don't know the model well . Some investors may not see the studio as a co-founder but just as another type of fund .

- Risk: Not being able to get money can stop the studio's work and growth.

- Solution: Have a strong founding team with a good record . Have a clear and strong investment idea and financial plan . Teach investors about the studio model's good points and success rates . Build trust by being open and keeping promises with early companies .

Handling Fights for Resources Inside the Studio

- Problem: With a main core team working on many startups at once, fights over limited resources (like the best designer's time or engineering help) will happen .

- Risk: Not having enough resources when needed can delay projects. It can cause problems inside the team and lead to bad results if good projects don't get enough help .

- Solution: Studio leaders need to give clear rules on who gets resources and what is most important . Use good methods for managing many companies to make go/no-go decisions for the whole group . Build a work culture where people help each other. Use tools like daily Scrum-style meetings so everyone knows current goals and expected work .

Making Sure Studio-Made Ventures Feel Real and Passionate

- Problem: Some people worry that teams hired by a studio or working on ideas they didn't create might not have the real passion and strong dedication often seen in traditional startups started by founders .

- Risk: Not enough deep passion could mean not enough effort or giving up when things get hard .

- Solution: Hire entrepreneurial people who love building ventures themselves or want to be professional CEOs . Make sure EIRs feel a strong connection to the ideas they work on . The studio founders' own passion and realness can also spread to the new companies . Focusing on solving real problems can also create passion .

The Risk of Not Ending Bad Ideas Fast Enough (Sunk Cost Problem)

- Problem: Even with ways to end bad ideas, feelings or the "sunk cost fallacy" (not wanting to waste past efforts) can make studios keep putting resources into projects that won't work .

- Risk: Wasting resources on failing projects can hurt other, better projects and the studio's overall money health .

- Solution: Keep many new ideas ready. This makes it easier to let go of weak ones. Set clear, unemotional rules, budgets, and timelines for checking ideas and getting results . Build a culture where quick, cheap failure is seen as a way to learn, not something bad.

Making the Studio Itself Able to Grow (Scalability)

- Problem: As the studio grows and manages more new companies, the main leaders can become stuck if they can't effectively "grow themselves" and share their knowledge .

- Risk: If leaders can't handle more, it can limit how much the studio can grow and how well it can help its companies .

- Solution: Help top managers grow, especially in skills for managing many companies . Make processes standard. Give decision-making power to others when it makes sense. Automate tasks . Build a setup and executive team that can work well even without the main founders always being directly involved in everything .

Dealing with these problems with good plans and a strong mindset is key to building a successful studio that can keep making winning companies.

Learning from the Best: Examples of Successful Venture Studios

Studying successful studios gives great ideas on good methods, different models, and proven plans in the venture-building world. Every studio has its own way. But looking at these leaders can give a guide for new studio creators and entrepreneurs. Here are some well-known examples:

Idealab: The First Mover

- Started: 1996 by Bill Gross .

- Why Important: Known as the first startup studio . Idealab helped shape the model. It has made over 150 companies with many good exits, including IPOs (like GoTo.com and NetZero) . Another source says it started over 75 companies .

- Focus: Tech companies in different areas.

- Key Lesson: Showed the studio model can work for a long time and have a big impact by testing many ideas at once.

Rocket Internet: The Global Grower

- Started: 2007 in Germany.

- Why Important: Known for quickly copying successful internet business models in new markets, often in developing countries . Launched big companies like Zalando and HelloFresh .

- Focus: E-commerce, online markets, and other internet businesses.

- Key Lesson: Mastered fast growth worldwide and running operations at a large scale, though sometimes with debate. Showed an early approach of working in many industries, focusing on speed and getting things done .

Betaworks: The NYC Innovator

- Location: New York City .

- Why Important: A major player that builds, speeds up, and invests in companies. They focus on media and new tech . Known for companies like Giphy, Bitly, and TweetDeck .

- Focus: Media, AI, augmented reality, LLMs, NLP, web3 .

- Key Lesson: Shows a model that mixes building with investing and an accelerator. Known for making a good environment for idea owners and focusing on specific tech areas .

eFounders (now Hexa): The SaaS Factory

- Location: Paris and Brussels .

- Why Important: Specializes in building B2B SaaS (Software as a Service) companies from scratch . Often pairs two co-founders (one CEO, one CTO) for each new company . Has a strong record with hits like Aircall, Mailjet, Front, and Spendesk .

- Focus: Business SaaS .

- Key Lesson: Mastered a repeatable way to create SaaS companies. Focuses on finding specific B2B needs and building strong founding teams . Their eClub model for investors is also interesting .

High Alpha: The B2B SaaS Pro with a VC Fund

- Location: Indianapolis .

- Why Important: Helped start the "venture studio" model by adding a VC fund to a startup studio in 2015 . Focuses on B2B SaaS. Partners with top leaders to co-create winning companies .

- Focus: B2B SaaS tech .

- Key Lesson: Shows a successful two-part model (studio + fund) . Gives expert help, money, and resources for the long term . They also run "Sprint Week" to check ideas and founder candidates . Started the Venture Studio Collective .

Atomic: The Co-Founding Way

- Location: San Francisco, Miami.

- Why Important: Uses a model of starting companies by matching great founders with the best ideas, teams, and resources . Known for direct help, giving more than just first money . Helped start companies like Hims & Hers and Bungalow .

- Focus: Different areas, based on finding strong ideas and founders.

- Key Lesson: Stresses the co-founding part. Partners deeply with entrepreneurs to build businesses from idea to launch and growth .

Founders Factory: Corporate-Backed Style

- Location: London, works globally .

- Why Important: Co-founds businesses from the start and also runs an accelerator program . A main feature is working with big companies (like Aviva, Fastweb, Nesta) . This gives a special "unfair advantage" through market knowledge, ways to reach customers, and chances to test products .

- Focus: Specific areas, often matching corporate partners (e.g., fintech, climate, health, deeptech) . Takes both studio-made and founder-brought ideas .

- Key Lesson: Shows how studios can work well with big companies to drive new ideas and create value for both startups and established businesses . Their step-by-step venture building process is well shared.

Science Inc.: Building Brands

- Location: Los Angeles .

- Why Important: Has a strong record of building successful consumer brands and tech companies. This includes the $1 billion sale of Dollar Shave Club . Also known for DogVacay .

- Focus: Consumer internet, e-commerce, mobile.

- Key Lesson: Shows success in finding and growing businesses that focus on consumers, often with strong branding and marketing.

Key Lessons from Successful Studios

- Clear Focus: Many top studios specialize in one industry, tech, or business type (like SaaS, consumer brands, media) . This helps them build deep knowledge and repeatable methods .

- Strong Processes: They have clear, repeatable ways to make ideas, check them, build, and grow companies .

- Talent Magnets: They are good at finding and helping grow both core team talent and startup leaders (EIRs/CEOs) .

- Value-Based Equity: They take a lot of equity, but they back it up with big help in ideas, resources, and lowering risk .

- Network Power: They use strong networks of investors, mentors, company partners, and past founders .

- Ability to Change: They learn from wins and losses. They keep making their models and methods better .

- Founder-Friendly (in their way): Even with high equity, they aim to give founders a place where they can succeed better than on their own .

By looking at these and other successful studios, we can learn important lessons for building or working with this active way of making new companies.

What's Next: Future Trends in Venture Studios

The venture studio model is not fixed. It keeps changing with new tech, market needs, and how people start businesses. Looking forward, several key trends are shaping the future of venture building.

More Specialization (Specific Industries, Tech like AI)

- Trend: Some studios work in many areas. But more are now focusing on specific small markets or new tech . This could be one industry (like fintech, healthtech, climate tech) or a specific tech wave (like AI/ML, blockchain, Web3, Quantum) .

- Why: Specializing helps studios get deeper knowledge in one area . They can make better plans, build more relevant networks, and create stronger links between their companies . This focus can lead to better new companies and a stronger offer for founders and investors in that area.

- Example: Studios focusing only on AI-driven SaaS. Or those working on green tech solutions. Betaworks, for example, now focuses on AI, LLMs, and web3 tools .

Growth of Corporate Venture Building

- Trend: More big companies are using or partnering with venture studios . They see it as a way to innovate, find new markets, and create new income streams outside their usual R&D .

- Why: Corporate venture studios (CVS) can mix startup speed and talent with a big company's resources, size, and market reach . This helps them overcome slow internal processes and innovate faster .

- Types: This can be studios built inside the company. Or it can be partnerships with outside studios.

- Benefits for Big Companies: Faster creation of new products/services . Access to outside talent. Changes in company culture. Chance for new high-growth business parts or strategic purchases .

Web3 and Decentralized Studios?

- Trend: With Web3, DAOs (Decentralized Autonomous Organizations), and blockchain tech growing, people are starting to explore new ways of venture building using these tools.

- Idea: This could mean idea making and checking by a community. It could use tokens for ownership and voting. Teams and resources could be spread worldwide.

- Issues & Chances: This is still new. It has big issues (unclear rules, hard to govern) and exciting chances (more access to talent and money, new ways to create value).

- Early Signs: Some studios are already focusing on Web3 tools or apps.

More Teamwork and Ecosystem Focus

- Trend: Studios see more value in working together instead of alone . This includes studios working with each other. It also means deeper connections with the wider startup world .

- Examples:

- Studio Networks: Groups like the Global Startup Studio Network (GSSN) help studios share knowledge and good methods .

- Partnerships: Studios teaming up with universities for research and talent. With VCs for later funding. And with service companies for special help .

- Building Local Scenes: Studios in new areas helping the local startup scene grow .

- Studio Networks: Groups like the Global Startup Studio Network (GSSN) help studios share knowledge and good methods .

Focus on Impact and Doing Good (Sustainability)

- Trend: More people care about social and environmental problems. This is leading some studios to build companies that make money but also do good for society or the planet .

- Why: Customers, workers, and investors increasingly want businesses that have a purpose . Studios can be strong tools for solving hard problems in areas like climate change, healthcare, and education .

- Example: Studios specializing in "impact tech." Or studios matching their work with the UN's Sustainable Development Goals (SDGs). Founders Factory notes that areas focused on a mission are often underfunded, which means there are chances there .

Using More Data in Venture Building

- Trend: Studios are using data analysis and AI more to make better decisions. Studios can take advantage of the recent AI venture capital investment trends because of their repeatable process setup and structure.

- How it's Used:

- Finding & Checking Ideas: Using data to see market trends and unmet needs. And to guess how well new ideas might do.

- Tracking Results: Watching key numbers for their companies more closely. This helps find areas needing help or support.

- Making Processes Better: Looking at the studio's own data to improve its venture building funnel and work better.

- Benefit: A more fact-based and efficient way to build companies. This could raise success rates even more.

The future of venture building is changing fast. Studios that can change, specialize, work with others, and have a clear purpose are likely to lead the next wave of new ideas.

Need Help with Your Venture Studio? Meet Your Expert Coach.

Building or improving a venture studio is a special and tough job. Maybe you're just starting to plan a new studio. Or you want to make your current one better. Or you need expert help to grow. An experienced coach can be a huge help. This is where an expert in venture studio creation and management can give vital help with your venture studio or startup studio.

About Attila Szigeti: A Practical Venture Studio Guide

If you need real-world, proven advice, Attila Szigeti is someone to know. He is a successful entrepreneur, venture builder, and author of the respected "Startup Studio Playbook" . Attila offers a lot of direct experience.

- Background & Experience: Attila has worked deep in venture building. He knows the details of making companies in a systematic way. His book gives a flexible guide and proven methods from successful venture builders . The Startup Studio Playbook is made to show you "how to do this." It aims to make it easier to create good new companies . Many people found that reading it helped a lot when talking to investors because they understood the studio way better .

- Practical Approach: Attila focuses on real, usable advice for studio creation and management. His ideas center on what really works. He helps you handle hard parts from ideas and team building to raising money and managing many companies.

- Connect with Attila:

- LinkedIn:

https://www.linkedin.com/in/aszig/ - Startup Studio Playbook: You can find his book on Amazon KDP here: https://www.amazon.com/Startup-Studio-Playbook-entrepreneurs-framework-ebook/dp/B07NVNYM4C

- LinkedIn:

How VentureSpeed.ai Can Help You Build or Improve Your Studio

VentureSpeed.ai, using Attila Szigeti's expert knowledge, offers special help for entrepreneurs, companies, and investors in the venture studio world. If you need help with startup studio problems or help with venture studio growth, we give:

- Strategy Advice:

- Setting your studio's vision, focus, and investment idea.

- Designing your studio's business model and how it works.

- Framework Help:

- Guidance on setting up your way to build ventures, from idea to exit.

- Using good methods for checking ideas, making MVPs, and building teams.

- Team Building & Leader Growth:

- Ways to find, train, and manage main teams and Entrepreneurs-in-Residence (EIRs).

- Coaching for studio leaders on growing operations and managing a group of companies.

- Financial Plan & Fundraising Help:

- Help in making realistic financial plans for your studio and its companies.

- Making a strong story and pitch deck for investors.

- Handling the hard parts of raising money for the studio.

- Process Improvement:

- Checking and improving your current studio ways to work better and have more success.

- Using KPIs and measures to track results well.

Our focus is on giving practical, usable advice that fits your specific needs. We use proven methods and flexible guides from resources like the Startup Studio Playbook.

Want to Build a Top Venture Studio? Book a 1:1 Strategy Call with Attila.

Don't try to figure out how to make a venture studio by yourself. Get expert ideas to speed up your work and avoid common mistakes.

If you are serious about building a successful venture studio or want to make your current one better, Schedule a 1:1 Strategy Call with Attila Szigeti today!

Final Thoughts: Are You Ready for the Venture Building Wave?